Introduction

If you’re learning how to create a personal budget, the goal isn’t to control every dollar perfectly. A beginner-friendly budget is a simple plan that helps you understand what you can afford, prioritize essentials, and reduce surprises.

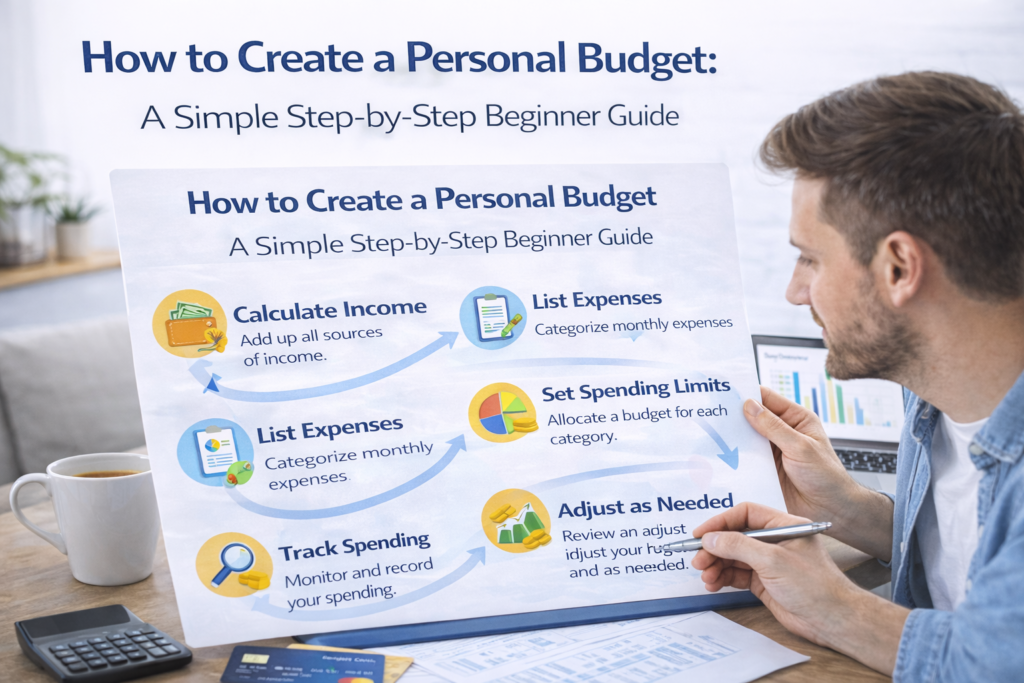

This guide shows a practical budgeting process you can adapt to your lifestyle.

Step 1: Know Your Monthly Income

Start with your monthly income range (or average). If income varies, estimate conservatively and adjust as you learn patterns.

Step 2: List Your Essential Expenses

Essentials often include:

- Housing

- Utilities

- Groceries

- Transportation

- Insurance (general category)

- Minimum required payments (if applicable)

Step 3: Identify Flexible Spending

Flexible categories may include:

- Dining out

- Entertainment

- Shopping

- Subscriptions

This step helps you see where you have room to adjust.

Step 4: Choose a Simple Budget Method

Category budgeting (beginner-friendly)

Create buckets:

- Essentials

- Flexible spending

- Savings

- Irregular expenses

Weekly budgeting

If monthly planning feels difficult, set weekly targets and check progress once a week.

Step 5: Include Savings (Start Small)

Saving is a habit. Even a small consistent amount can support preparedness.

Step 6: Plan for Irregular Expenses

List occasional costs (annual renewals, holidays, school costs) and set aside small amounts when possible.

Step 7: Review Weekly and Adjust Monthly

A budget improves with review. The best budget is one you actually use.

FAQ

Do I need to budget if my income is low?

A basic budget can still help by improving clarity and planning.

How detailed should my budget be?

As simple as possible while still being useful.

How often should I review my budget?

Weekly check-ins are helpful; monthly adjustments keep it realistic.

Final Thoughts

Creating a personal budget is about clarity and consistency. Start simple, review regularly, and adjust over time.