Introduction

Personal finance can feel like a huge topic: budgeting, saving, credit, debt, loans, and everything in between. But you don’t need to master everything at once to improve your money management.

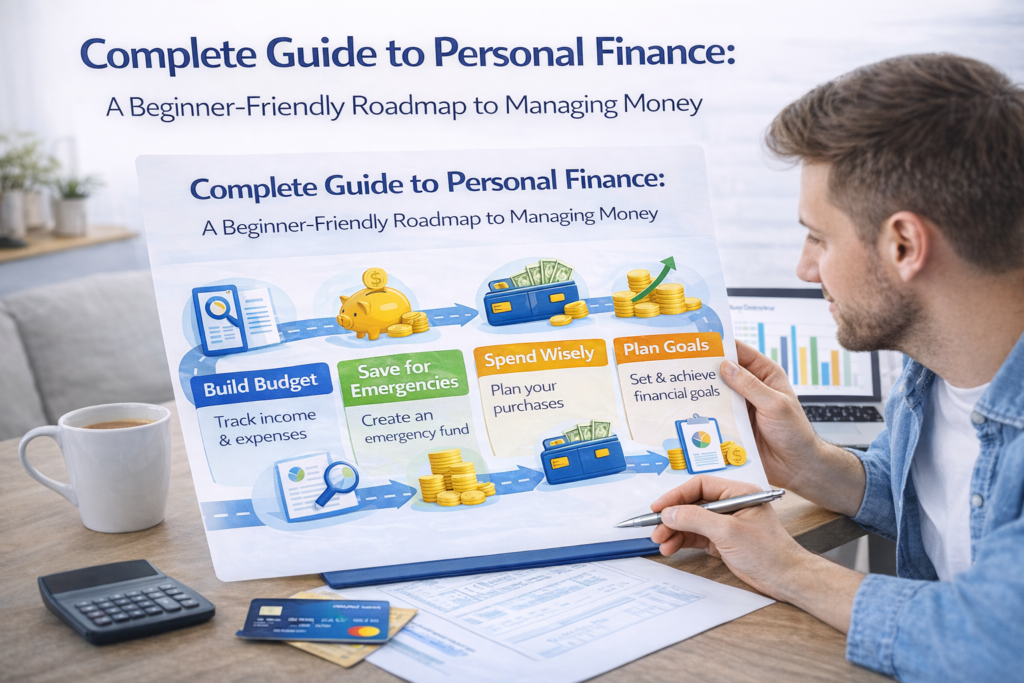

A practical approach is to learn personal finance as a set of connected basics:

- understanding income and cash flow

- planning expenses with a simple budget

- tracking spending patterns

- building consistent saving habits

- reviewing and adjusting routines over time

This complete guide to personal finance is designed as a beginner-friendly roadmap. It focuses on the foundational ideas most people use in everyday life, with a clear structure you can return to as your needs change.

What Is Personal Finance?

Personal finance refers to how individuals manage their money in everyday life. It includes:

- earning income

- planning and paying expenses

- saving and preparing for irregular costs

- understanding financial habits

- making informed decisions over time

At a beginner level, personal finance is less about complex strategies and more about building clarity and consistency.

The 6 Core Areas of Personal Finance

1) Income Awareness

Income awareness means knowing:

- where your income comes from

- how often you’re paid

- how consistent income is month to month

Why it matters: Your spending plan only works if it’s built on realistic income expectations.

If income varies, planning conservatively and reviewing regularly can help reduce surprises.

2) Cash Flow (What Comes In vs. What Goes Out)

Cash flow is the difference between income and expenses.

Beginner cash flow habits include:

- listing essential monthly expenses

- estimating flexible spending categories

- noticing whether you tend to feel tight or comfortable by month-end

Cash flow awareness helps you plan realistically without guessing.

3) Budgeting (A Simple Spending Plan)

A budget is a plan for how you intend to use your income.

Beginner budgets work best when they are simple and flexible. A common structure is:

- Essentials

- Flexible spending

- Savings

- Irregular expenses

Budgeting supports clarity and helps reduce overspending patterns that happen by accident.

4) Expense Tracking and Spending Awareness

Budgeting is the plan. Tracking is the feedback.

Tracking helps you:

- see real spending patterns

- spot recurring charges and subscriptions

- adjust category targets based on reality

A weekly transaction review is often a sustainable beginner approach.

5) Saving Basics

Saving supports flexibility and preparedness.

Beginner saving works best as a habit:

- start small

- focus on consistency

- plan around irregular expenses

Savings can help reduce stress when unexpected costs appear.

6) Financial Habits and Routines

Personal finance is heavily influenced by habits.

Strong habits include:

- weekly money check-ins

- monthly planning resets

- simple tracking routines

- realistic goal setting

A consistent routine often matters more than the tool you use.

How to Start Personal Finance Step by Step

Step 1: Build a simple overview

Write down:

- monthly income range (or average)

- essential monthly expenses

- major recurring bills and due dates

This overview creates the foundation for your budget and routines.

Step 2: Choose a beginner budget method

Select a method you can maintain:

- category budget (broad buckets)

- weekly budget targets

- priority-first plan (essentials first)

Step 3: Track spending weekly

Use a weekly review to categorize spending and spot patterns.

Step 4: Plan for irregular expenses

List predictable occasional costs and set aside small amounts when possible.

Step 5: Add a small saving habit

The goal is consistency. Increase gradually when practical.

Common Personal Finance Challenges (And What Helps)

Challenge: Overspending

Helpful habits:

- track weekly

- set weekly targets for flexible categories

- use a pause rule for non-essential buys

Challenge: No clear plan

Helpful habit:

- start with essentials and a simple budget

Challenge: Irregular expenses

Helpful habit:

- create an irregular expense category/buffer

Challenge: Inconsistent routines

Helpful habit:

- schedule a weekly check-in time

Helpful Tools (Keep It Simple)

You don’t need advanced tools. Many beginners succeed with:

- a notes app tracker

- a simple spreadsheet

- weekly bank transaction review

- a calendar reminder for bills and check-ins

Choose tools that reduce friction.

FAQ

What is the most important part of personal finance?

For many beginners, the most important part is consistent awareness—knowing income, tracking spending patterns, and reviewing weekly.

Do I need a budget to manage personal finances?

A simple spending plan helps most people. It doesn’t need to be detailed to be useful.

How long does it take to improve money habits?

It varies, but consistent weekly routines often create noticeable improvement over time.

Is personal finance only about saving money?

No. Personal finance includes planning, spending awareness, habits, and organization—not just saving.

Final Thoughts

Personal finance becomes much easier when you treat it as a set of fundamentals you build over time. Start with income awareness, a simple budget, and weekly tracking. Add saving and irregular expense planning as you go.

Consistency matters more than complexity. A simple system you maintain will outperform a perfect system you abandon.