Introduction

Credit cards are common in everyday life, but they can feel confusing when you’re new to them. You may hear terms like “statement balance,” “billing cycle,” “APR,” and “credit limit” and wonder what they actually mean—and how they affect your day-to-day finances.

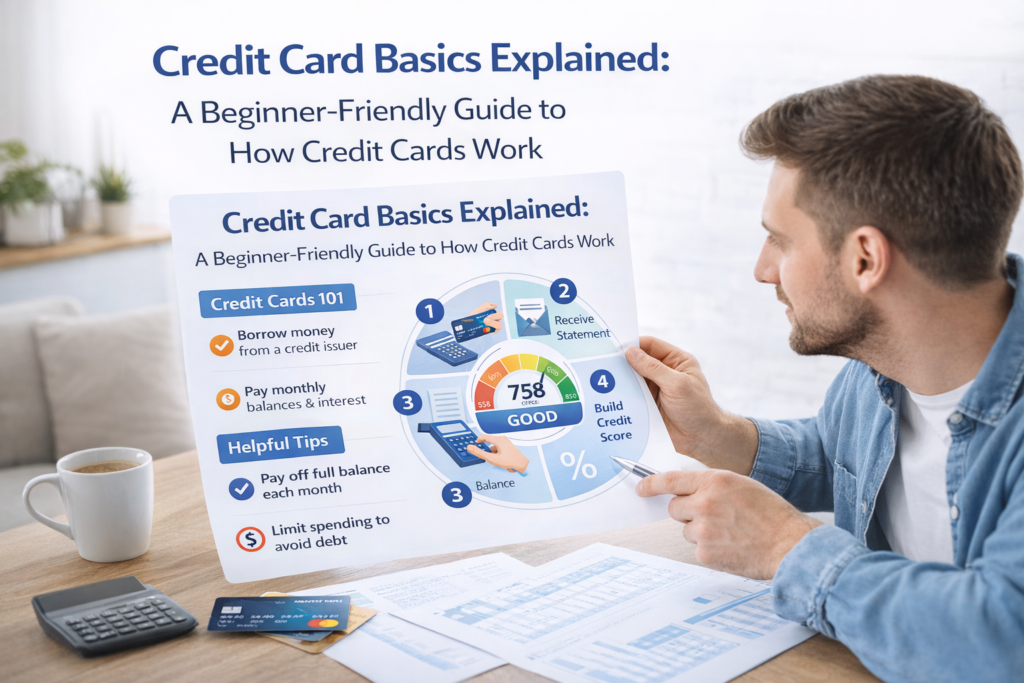

This guide provides credit card basics explained in clear, beginner-friendly language. You’ll learn how credit cards work, how statements and payments fit into a monthly cycle, what key terms mean, and which habits generally help people use credit cards responsibly.

The goal here isn’t to overwhelm you with details. It’s to give you a practical foundation so you can understand what you’re seeing on a statement and make sense of how credit cards function.

What Is a Credit Card?

A credit card is a payment tool that lets you borrow money up to a set amount (your credit limit) to make purchases. Instead of paying immediately from your bank account (like a debit card), you charge purchases to your credit card, and then you repay what you owe based on a monthly billing cycle.

At the end of each billing cycle, the card issuer sends a statement that summarizes:

- purchases made during that period

- payments received

- fees (if any)

- the statement balance

- the minimum payment

- the payment due date

Credit Card Basics: Key Terms You Should Know

Credit limit

Your credit limit is the maximum amount you can charge on the card at one time. If your limit is $2,000, you generally can’t exceed that amount without paying down some of the balance or having transactions declined.

Available credit

Available credit is the remaining amount you can spend. It’s usually your credit limit minus what you currently owe (including pending transactions).

Current balance vs. statement balance

This is one of the most confusing beginner concepts:

- Current balance: what you owe right now based on recent activity

- Statement balance: the amount shown on your monthly statement when the billing cycle closes

You might make purchases after the statement closes; those will appear in your current balance but not on that statement.

Minimum payment

The minimum payment is the smallest amount required by the due date to keep the account current under the statement terms. Paying only the minimum may leave a remaining balance.

Payment due date

The due date is the date by which your payment must be received (or posted) to be considered on time, based on the issuer’s rules.

APR (Annual Percentage Rate)

APR is the annual interest rate associated with carrying a balance, shown as a percentage. How interest applies depends on the card’s terms and how balances are handled.

Because each card has its own disclosures, it’s helpful for beginners to read the card’s terms for details on APR, grace periods, and fees.

The Monthly Credit Card Cycle: Billing Cycles and Statements

Most credit cards operate on a repeating monthly rhythm.

1) You make purchases during a billing cycle

During the month, you charge purchases to your card.

2) The billing cycle closes

At a certain date, the billing cycle ends. The issuer generates a statement.

3) You receive a statement

The statement summarizes activity during that cycle and shows the statement balance, minimum payment, and due date.

4) You make a payment by the due date

Payments made by the due date determine whether the account is paid down and whether interest or fees apply (depending on card terms and your situation).

Beginner takeaway: Statements are monthly snapshots. Understanding the cycle is the easiest way to reduce confusion.

How Payments Affect Your Balance

When you make a payment, your balance generally decreases. But timing matters.

- A payment made before the statement closes may reduce what appears as your statement balance.

- A payment made after the statement closes affects your current balance but doesn’t change the statement that was already generated.

This is why you might see a statement balance that doesn’t match what your app shows as the current balance.

Interest and APR: The Beginner-Level Explanation

Interest is one of the most misunderstood parts of credit cards.

Here’s a simple way to think about it:

- Credit card interest may apply when a balance is carried under the issuer’s terms.

- Many cards have rules about when interest is charged, often tied to whether the statement balance is paid by the due date.

- Details vary widely, and the most accurate information is found in the card’s disclosure documents.

Beginner tip: If you’re unsure how interest applies to your specific card, review the terms section related to “Purchase APR,” “Grace Period,” and “Interest Charges.”

(Exact terms and calculations depend on the issuer and agreement.)

Common Fees (And Why They Matter)

Credit cards can include fees. You don’t need to memorize every fee type, but it helps to recognize common ones:

Annual fee

Some cards charge a yearly fee for the account.

Late payment fee

If a payment is late based on the issuer’s rules, a late fee may apply.

Foreign transaction fee

Some cards charge fees for purchases processed outside your country or in another currency.

Cash advance fee

Cash advances often have different rules than regular purchases and may include additional fees and different interest terms.

Balance transfer fee

Some cards charge a fee to transfer a balance from another account.

Beginner habit: Review your statement monthly so fees don’t go unnoticed.

Credit Utilization: A Simple Concept

Credit utilization generally refers to how much of your available credit you’re using.

Example:

- Credit limit: $1,000

- Balance: $300

- Utilization: about 30%

Utilization is commonly discussed alongside credit scores, but even without focusing on scoring, it’s useful as a budgeting awareness tool: high utilization can signal heavy reliance on credit at that moment.

(Scoring impacts depend on the scoring model and the full credit profile.)

Credit Cards vs. Debit Cards

Debit card

Typically pulls money directly from your bank account at the time of purchase.

Credit card

Uses a line of credit and requires repayment later through statement billing.

Practical difference: Credit cards involve statements, due dates, potential interest, and credit limits. Debit cards usually do not.

Responsible Credit Card Use (Educational Concepts)

Responsible use is about clarity and routine, not perfection. Helpful educational habits include:

Review your statement each month

Statements show you what happened during the cycle—this reduces confusion and supports awareness.

Track spending patterns

Tracking helps prevent “small purchases adding up” surprises.

Know your due date

A reminder system helps you avoid missing payment timing.

Avoid treating the credit limit as “extra income”

A credit limit is borrowing capacity, not money added to your paycheck.

Keep your system simple

A basic budget and weekly review can make credit cards easier to manage.

Common Beginner Mistakes (And How to Avoid Them)

Mistake 1: Confusing statement balance and current balance

Fix: treat the statement as a snapshot and the app as “real-time” activity.

Mistake 2: Ignoring the statement entirely

Fix: a monthly statement review is one of the best beginner habits.

Mistake 3: Underestimating recurring charges

Fix: monthly subscription review helps spot forgotten charges.

Mistake 4: Forgetting fees exist

Fix: review disclosures and watch statements for fee line items.

Mistake 5: Overspending with small purchases

Fix: track weekly and set simple category targets.

FAQ

What are the basic parts of a credit card?

The basics include a credit limit, billing cycle, statement balance, minimum payment, due date, and card terms such as APR and fees.

What is the difference between statement balance and current balance?

Statement balance is the amount listed when the billing cycle closes. Current balance updates with new purchases and payments.

Do credit cards always charge interest?

Not always. Whether interest applies depends on card terms and how balances are handled within the billing cycle.

What does APR mean?

APR is the annual interest rate associated with carrying a balance, based on the card’s terms.

What is a minimum payment?

The minimum payment is the smallest payment required by the due date under the statement terms.

Final Thoughts

Credit card basics become much easier once you understand the monthly rhythm: purchases happen during a billing cycle, the statement closes, and a payment is due. Learning key terms—credit limit, statement balance, due date, minimum payment, APR, and fees—helps you read statements with confidence and avoid common beginner confusion.

A simple routine—weekly spending awareness plus monthly statement review—can make credit cards feel far more manageable.