Introduction

Budgeting is often misunderstood. Some people think a budget is restrictive, complicated, or only necessary when money feels tight. In reality, budgeting is simply a plan—a way to understand your income, organize your expenses, and make day-to-day decisions with more clarity.

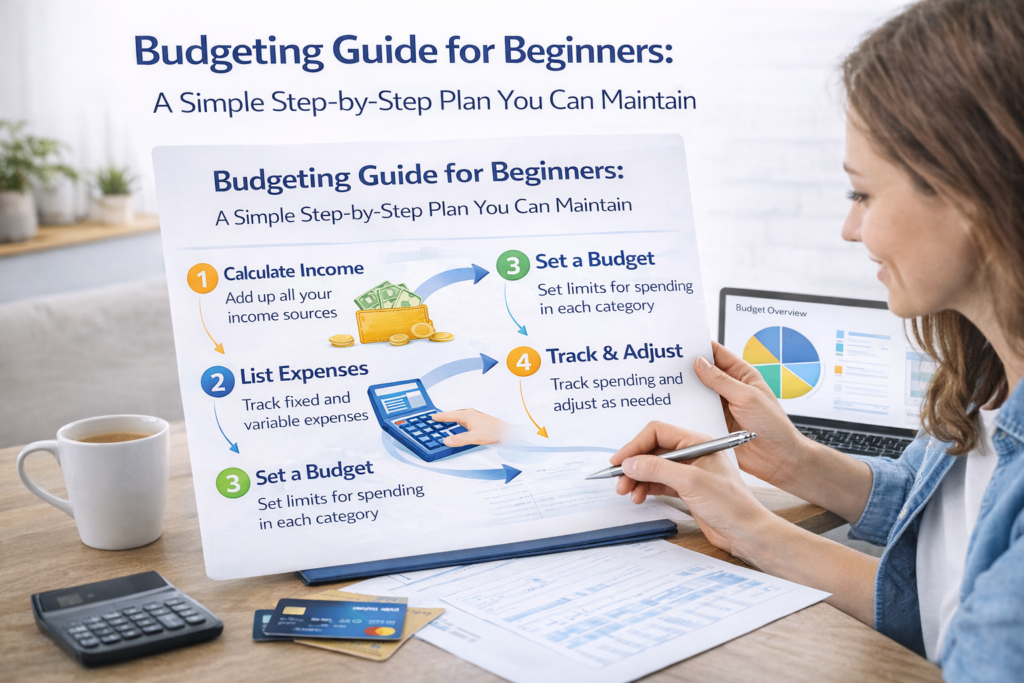

This budgeting guide for beginners is designed to be practical and realistic. You won’t need advanced tools or complex spreadsheets. The goal is to help you build a simple system you can maintain, using habits like weekly check-ins and broad spending categories.

Budgeting does not have to be perfect to be useful. A “good” beginner budget is one that:

- feels manageable

- reflects real life

- helps you plan for essentials

- reduces financial surprises over time

Let’s walk through the basics step by step.

What Is a Budget?

A budget is a plan for how you intend to use your money over a time period (often monthly). A beginner-friendly budget helps you answer:

- How much money is coming in?

- What essential expenses must be covered first?

- How much flexibility do I have for non-essentials?

- Can I set aside anything for savings or irregular expenses?

- What changes might I need to make if something shifts?

Budgeting is not about tracking every penny forever. It’s about creating clarity and direction.

Why Budgeting Helps Beginners

Beginners often feel stressed about money because decisions are made without a clear structure. Budgeting helps create structure by:

Improving awareness

You see where money typically goes and which categories matter most.

Reducing surprises

A plan that includes essentials and irregular expenses makes month-end less stressful.

Supporting better decision-making

When you know your targets, spending decisions become more intentional.

Building habits over time

Budgeting works best with consistent review, not a one-time setup.

Step 1: Start With Income (Keep It Realistic)

The first step in budgeting is knowing what you have to work with.

If income is consistent

Use your expected monthly take-home amount (or your closest estimate).

If income varies

Consider using:

- a conservative baseline (lower estimate)

- a monthly range

- a recent average

Beginner tip: A budget is easier to maintain when it’s based on realistic numbers, not best-case assumptions.

Step 2: List Essential Expenses First

Essentials are the foundation of a beginner budget. These are the expenses that support basic living and core responsibilities.

Common essentials include:

- Housing

- Utilities

- Groceries

- Transportation

- Insurance (general category)

- Minimum required payments (if applicable)

This step matters because many budgeting challenges happen when flexible spending is planned first and essentials are left “to fit.” Budgeting is easier when essentials are protected first.

Step 3: Identify Flexible Spending Categories

Flexible spending is where most adjustment happens. These are the categories that vary and can be shaped by choices.

Examples:

- Dining out

- Entertainment

- Shopping/personal spending

- Subscriptions and digital purchases

- Convenience spending (fees, add-ons)

Flexible spending isn’t “bad.” It just needs a place in your plan so it doesn’t quietly take over.

Step 4: Choose a Beginner-Friendly Budget Method

There are many budgeting approaches. The best one is the one you will maintain.

Method A: Simple category budget (recommended for beginners)

Use broad buckets:

- Essentials

- Flexible spending

- Savings

- Irregular expenses

This method is easy to maintain because it doesn’t require dozens of labels.

Method B: Weekly budgeting

If monthly budgeting feels too abstract:

- set weekly targets for groceries, dining out, and personal spending

- check progress each week

- adjust the next week if needed

Weekly budgeting provides quick feedback and feels more “real” for many beginners.

Method C: Priority-first budgeting

This approach is:

- plan essentials first

- set a small amount for irregular expenses and savings

- allocate what remains to flexible spending

Priority-first budgeting works well when you want a clear order of operations.

Step 5: Add an “Irregular Expenses” Category

Many budgets fail because they only include monthly bills and forget irregular costs.

Examples of irregular expenses:

- annual renewals

- car repairs/maintenance

- seasonal spending

- gifts/holidays

- school-related costs

A beginner-friendly approach is to add a category called Irregular Expenses and contribute a small amount to it consistently. Even modest amounts can reduce financial disruptions over time.

Step 6: Include Savings in a Realistic Way

Savings can be part of a beginner budget, but it needs to be realistic and sustainable.

Beginner-friendly saving tends to focus on:

- small consistent amounts

- habit-building

- gradual improvement

Some people start by saving first; others start by building awareness and then adding savings as the plan stabilizes. What matters is consistency over time.

Step 7: Track Spending (Lightly) to Improve Your Budget

Budgeting is planning. Tracking is feedback.

A simple tracking routine:

- review transactions weekly

- categorize spending broadly

- note which categories are higher than expected

The goal is not perfect tracking—it’s learning what’s realistic so your budget reflects real life.

Step 8: Use a Weekly Check-In to Stay Consistent

A weekly check-in is one of the most helpful beginner habits.

In 10–15 minutes, you can:

- review recent spending

- check upcoming bills

- compare spending to your plan

- adjust the next week’s flexible spending target

This habit helps prevent month-end surprises and makes budgeting feel less stressful.

Step 9: Do a Monthly Reset (Simple and Practical)

Once per month, do a quick reset:

- review totals by category

- update your irregular expense list

- adjust your budget based on reality

- set one simple focus goal for the next month

Budgets improve through review. A beginner budget is a living plan—not a one-time document.

Common Budgeting Mistakes Beginners Make

Mistake 1: Too many categories

Fix: use broad buckets and simplify.

Mistake 2: Planning without tracking

Fix: weekly reviews help your plan match reality.

Mistake 3: Ignoring irregular expenses

Fix: add an irregular expenses category.

Mistake 4: Making the budget too strict

Fix: build in flexibility so it’s sustainable.

Mistake 5: Expecting perfection immediately

Fix: treat budgeting like learning—steady improvement over time.

Beginner Budget Example (Simple Buckets)

A beginner budget can look like this:

- Essentials: housing, utilities, groceries, transportation

- Flexible spending: dining out, entertainment, shopping

- Savings: small consistent contribution

- Irregular expenses: seasonal and occasional costs

You can keep it simple and still get real value.

Frequently Asked Questions (FAQ)

What is the best budgeting method for beginners?

A simple category budget with broad buckets is often easiest to maintain. Weekly budgeting can also work well if monthly planning feels difficult.

Do I need a budgeting app?

No. Many beginners succeed with a notes app, spreadsheet, or weekly bank transaction review. Consistency matters more than tools.

How often should I review my budget?

Weekly check-ins are helpful for staying on track. A monthly reset helps keep the plan realistic.

Why does my budget feel like it “never works”?

Common reasons include irregular expenses, unrealistic category targets, or tracking inconsistently. Simplifying categories and reviewing weekly can help.

Final Thoughts

This budgeting guide for beginners comes down to a few core ideas: keep it simple, plan essentials first, include irregular expenses, track lightly, and review weekly. A budget doesn’t need to be perfect—it needs to be consistent.

Start with a simple plan you can maintain. Over time, small adjustments will make your budget more accurate and your finances more organized.