Introduction

Financial planning can sound like something only experts do—something complicated, technical, or reserved for people with high incomes. But at a basic level, financial planning is simply the process of organizing your money decisions so your day-to-day life feels more stable and less reactive.

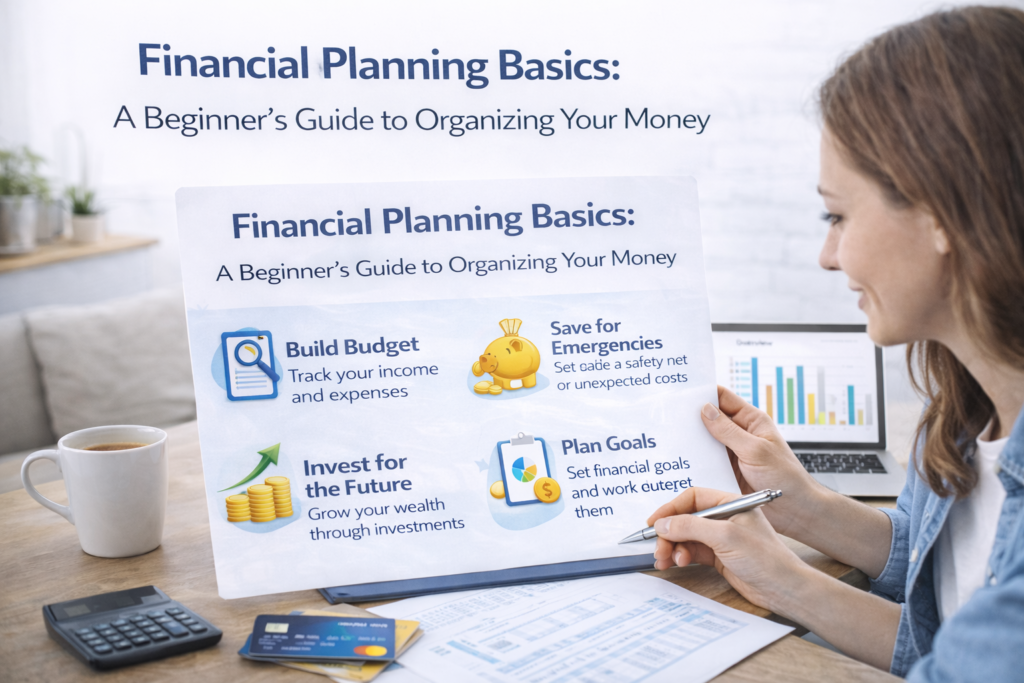

Financial planning basics focus on:

- understanding what comes in (income)

- knowing what goes out (expenses)

- planning for essentials and irregular costs

- setting realistic goals

- building consistent routines

You don’t need complex spreadsheets or advanced tools. You need a simple plan you can review and adjust over time.

This guide explains financial planning in a beginner-friendly way, with practical steps that work for everyday life.

What Is Financial Planning?

Financial planning is the process of organizing your money decisions so they align with your priorities and responsibilities. At the beginner level, planning usually includes:

- cash flow awareness

- a simple budget (spending plan)

- saving habits

- goal setting

- routine reviews (weekly and monthly)

Financial planning isn’t a one-time event. It’s an ongoing practice that improves with consistency.

Why Financial Planning Matters

Planning helps reduce uncertainty and supports better decision-making.

Common benefits include:

- fewer surprises from bills and irregular expenses

- clearer priorities in spending decisions

- more organization around money routines

- greater confidence over time

Even simple planning steps can make money feel more manageable.

Step 1: Build Cash Flow Awareness

Cash flow is the relationship between income and expenses.

Beginner cash flow awareness includes:

- knowing your monthly income range

- listing monthly essential expenses

- identifying flexible spending categories

- understanding whether you tend to have “extra” at month-end or feel tight

If income varies, you can plan using a conservative estimate and adjust as patterns become clearer.

Step 2: Create a Simple Spending Plan

A spending plan is a practical, beginner-friendly form of budgeting.

A simple structure:

- Essentials

- Flexible spending

- Savings

- Irregular expenses

The goal is to make sure essentials are covered first, then allocate the remaining money intentionally.

Step 3: Identify Regular vs. Irregular Expenses

Many budgets fail because they only account for regular monthly bills.

Regular expenses

Costs that show up monthly:

- housing

- utilities

- groceries

- transportation

- subscriptions

Irregular expenses

Costs that appear occasionally:

- annual renewals

- car maintenance

- seasonal expenses

- gifts and holidays

- school-related costs

Planning basics include listing irregular expenses and setting aside small amounts over time when possible.

Step 4: Set Realistic Financial Goals

Beginner planning works best with goals that are:

- clear

- realistic

- measurable

- tied to your current situation

Examples of realistic planning goals:

- track spending weekly for one month

- create a list of essential expenses

- plan for irregular expenses with a small monthly amount

- build a simple saving habit

The point of goals is direction—not pressure.

Step 5: Build a Saving Routine

Saving supports flexibility and preparedness.

At the beginner stage:

- start small

- aim for consistency

- build the habit

- increase gradually when practical

Saving routines work best when they’re paired with planning for irregular expenses—so your budget is less likely to be disrupted.

Step 6: Create a Weekly and Monthly Review Habit

Financial planning improves through review.

Weekly check-in (10–15 minutes)

- review spending from the last week

- check upcoming bills

- adjust flexible spending for the next week

Monthly review (20–30 minutes)

- compare spending to your plan

- update irregular expenses

- adjust categories based on reality

- set a simple focus for next month

This routine keeps your plan realistic and prevents drift.

Step 7: Keep Planning Simple as Your Life Changes

Planning is most helpful when it adapts.

Life changes may include:

- changes in income

- moving or housing changes

- new responsibilities

- changes in transportation needs

- seasonal cost shifts

A simple plan is easier to adjust and maintain, which is why beginner financial planning should avoid unnecessary complexity.

Common Beginner Planning Mistakes

Mistake 1: Planning once and never reviewing

Fix: weekly check-ins and monthly updates.

Mistake 2: Ignoring irregular expenses

Fix: list them and plan small contributions.

Mistake 3: Overcomplicating categories

Fix: use broad buckets.

Mistake 4: Setting unrealistic goals

Fix: prioritize achievable steps.

Mistake 5: Expecting instant improvement

Fix: focus on consistency over time.

Frequently Asked Questions (FAQ)

What are financial planning basics?

Financial planning basics include cash flow awareness, a simple spending plan, saving habits, realistic goal setting, and routine reviews.

Do I need financial planning if I have a small income?

Basic planning can help at any income level because it improves clarity and organization.

How often should I review my financial plan?

Weekly check-ins help most beginners; monthly reviews keep the plan realistic.

Is financial planning the same as budgeting?

Budgeting is one part of financial planning. Planning includes budgeting plus routines, goals, and review habits.

Final Thoughts

Financial planning basics are about building a simple system you can maintain. When you understand your cash flow, plan essentials, account for irregular expenses, and review regularly, money decisions become clearer and less stressful.

Start small, keep it simple, and let consistency do the work over time.