Introduction

Credit cards are common, but they can feel confusing when you’re new to them. Terms like “statement balance,” “billing cycle,” “APR,” and “minimum payment” can make credit cards seem more complicated than they need to be.

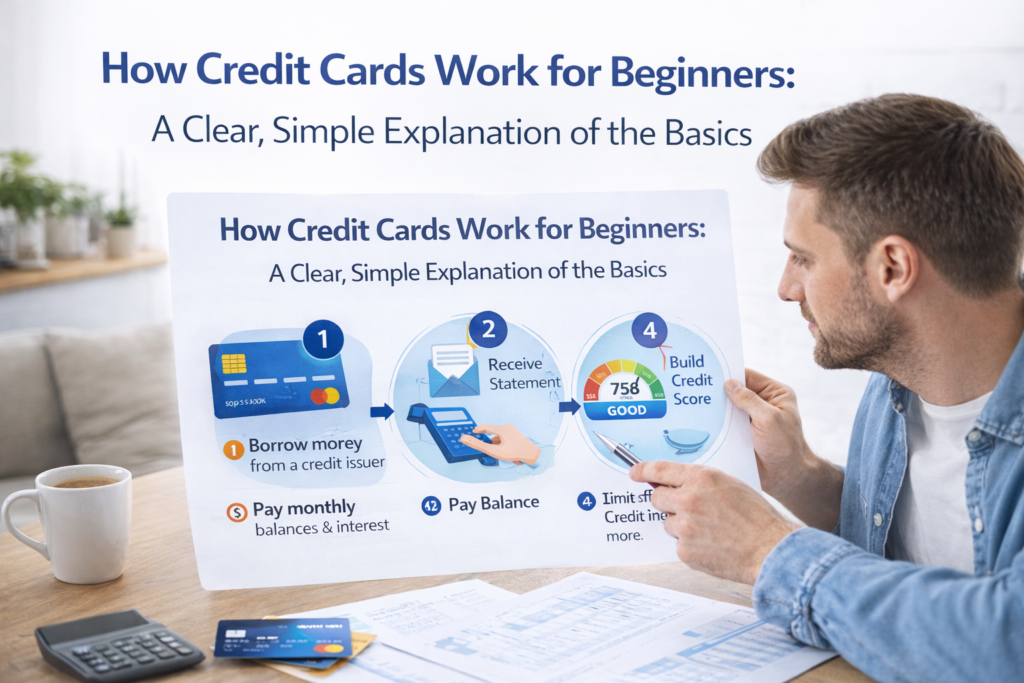

Understanding how credit cards work for beginners starts with a simple idea: a credit card allows you to make purchases using a line of credit, then pay that amount back based on a monthly statement cycle. The details—like interest, fees, and payment timing—are what determine how a credit card affects your finances.

This guide explains the basics clearly, focusing on how credit cards function, what common terms mean, and what responsible use generally looks like from an educational perspective.

What Is a Credit Card?

A credit card is a payment tool that lets you borrow money up to a set limit to make purchases. Instead of paying immediately from a bank account (as with a debit card), credit card purchases are added to your balance.

At the end of a billing period, the card issuer sends a statement showing:

- how much you spent

- what you owe

- due dates and minimum payment amounts

- any fees or interest (if applicable)

Key Parts of How Credit Cards Work

1) Credit limit

Your credit limit is the maximum amount you can charge to the card at one time. If your limit is $1,000, you generally can’t have more than $1,000 in charges outstanding without paying some of it down.

2) Available credit

Available credit is your credit limit minus what you’ve already charged (plus any pending transactions).

3) Current balance vs. statement balance

These are often different:

- Current balance: what you owe right now based on charges and payments to date

- Statement balance: the balance shown on the statement at the end of the billing cycle

Many beginners get confused here, so it helps to understand the timing.

Billing Cycles and Statements (The Monthly Rhythm)

Credit cards operate in repeating billing cycles—often around a month long.

How a billing cycle works

- You make purchases during the billing cycle

- The billing cycle closes on a specific date

- A statement is generated showing the statement balance

- You have a due date to make at least a minimum payment

A key beginner concept: the statement is a snapshot taken at the end of the billing cycle.

The Payment Due Date

Your statement shows a payment due date. This is the date by which a payment must be received (or posted) to be considered on time.

Credit cards typically require at least the minimum payment by the due date. The amount due depends on your issuer’s rules and your statement balance.

Minimum Payment: What It Means

The minimum payment is the smallest amount you’re required to pay by the due date to keep the account in good standing (according to the statement terms). It’s usually a small portion of the statement balance.

From an educational standpoint, it helps to understand:

- paying only the minimum may leave a remaining balance

- remaining balances can potentially lead to interest depending on the card terms

- paying more than the minimum can reduce what remains owed

(Exact outcomes depend on the specific card agreement.)

APR and Interest Basics (Beginner Explanation)

APR stands for Annual Percentage Rate. It’s the interest rate associated with carrying a balance, expressed annually. Interest calculations can vary by issuer and terms, but the main beginner takeaway is:

- If a balance is carried past certain conditions, interest may apply.

- If the full statement balance is paid by the due date (common issuer structure), interest is often avoided on purchases—though this depends on your card terms.

Because terms vary, beginners benefit from reading the card’s disclosure documents, especially sections related to purchase APR, grace periods, and how interest is calculated.

Grace Period (What It Usually Means)

Many credit cards have a grace period—a window of time between the statement closing and the due date when interest may not apply to new purchases if certain conditions are met.

Important nuance:

- Grace period rules vary.

- Carrying a balance can change how a grace period works.

This is why understanding statements and payment timing matters.

Fees Beginners Should Know About

Credit cards may come with fees depending on the issuer and terms. Common examples include:

Annual fee

Some cards charge a yearly fee for holding the card.

Late payment fee

If a payment is late (based on issuer rules), a late fee may apply.

Foreign transaction fee

Some cards charge fees for purchases made in foreign currencies or through foreign merchants.

Balance transfer fee / cash advance fee

Some card features can come with additional fees. Cash advances, in particular, often work differently than purchases and may have different cost structures.

Beginners don’t need to memorize every fee type, but they should know that fees exist and are listed in the card’s disclosures.

Credit Utilization (Simple Concept)

Credit utilization generally refers to how much of your available credit you’re using at a given time.

Example:

- Credit limit: $1,000

- Balance: $300

- Utilization: about 30%

Utilization is often discussed in relation to credit scoring models, but the key beginner idea is that high utilization can indicate heavy reliance on credit at that moment. (Exact scoring impact depends on the model and overall credit profile.)

How Payments Are Applied

Payment allocation can depend on issuer policies and applicable regulations. In general, payments reduce the amount owed, but where the payment applies (purchases, fees, etc.) can vary.

For beginners, the practical takeaway is:

- reviewing statements helps you understand how your balance changes over time

- consistent payments help keep the account manageable

Credit Cards vs. Debit Cards

Debit card

A debit card typically draws money directly from your bank account at the time of purchase.

Credit card

A credit card charges purchases to a credit line and requires repayment later based on statement timing.

Both can be used responsibly, but they function differently in terms of payment timing, statements, and potential interest.

Responsible Credit Card Use (Educational Concepts)

This section is educational and general; specific choices depend on individual circumstances.

Common responsible-use concepts include:

- understanding your billing cycle and due dates

- knowing what the statement balance represents

- avoiding spending more than you can reasonably repay

- tracking purchases to prevent surprises

- reviewing statements for accuracy

These habits help beginners treat credit cards as a structured tool rather than a source of confusion.

Common Beginner Mistakes With Credit Cards

Mistake 1: Not understanding the statement vs. current balance

Fix: treat the statement as a monthly snapshot; review it carefully.

Mistake 2: Ignoring the due date

Fix: use reminders and set a consistent review routine.

Mistake 3: Treating the credit limit as “free money”

Fix: remember it’s borrowed money that must be repaid.

Mistake 4: Forgetting fees

Fix: read the fee section in the card terms and review statements.

Mistake 5: Overspending from small purchases

Fix: track spending weekly and use a simple budget.

How Credit Cards Connect to Personal Finance Basics

Credit cards are easier to manage when you already have:

- a simple budget

- expense tracking habits

- a weekly money check-in routine

That’s why personal finance fundamentals and credit education work well together.

Frequently Asked Questions (FAQ)

How do credit cards work for beginners?

You make purchases on a credit line during a billing cycle, receive a monthly statement, and make payments by the due date. Terms determine whether interest or fees apply.

What is the difference between current balance and statement balance?

Current balance reflects spending and payments up to now. Statement balance is the amount shown on your monthly statement when the billing cycle closes.

Do credit cards always charge interest?

Not always—interest depends on the card terms, payment timing, and whether a balance is carried under the issuer’s rules.

What is APR?

APR is the annual rate used to calculate interest on carried balances, based on the card’s terms.

What is a minimum payment?

It’s the smallest payment required by the due date to keep the account current according to the statement terms.

Final Thoughts

Credit cards are simpler once you understand the monthly cycle: purchases accumulate during a billing period, a statement is issued, and payments are due by a certain date. Learning the basic terms—statement balance, due date, minimum payment, APR, and fees—helps beginners use credit cards with more clarity and less stress.

The most helpful beginner approach is to stay organized: review statements, track spending patterns, and keep a simple money routine.