Introduction

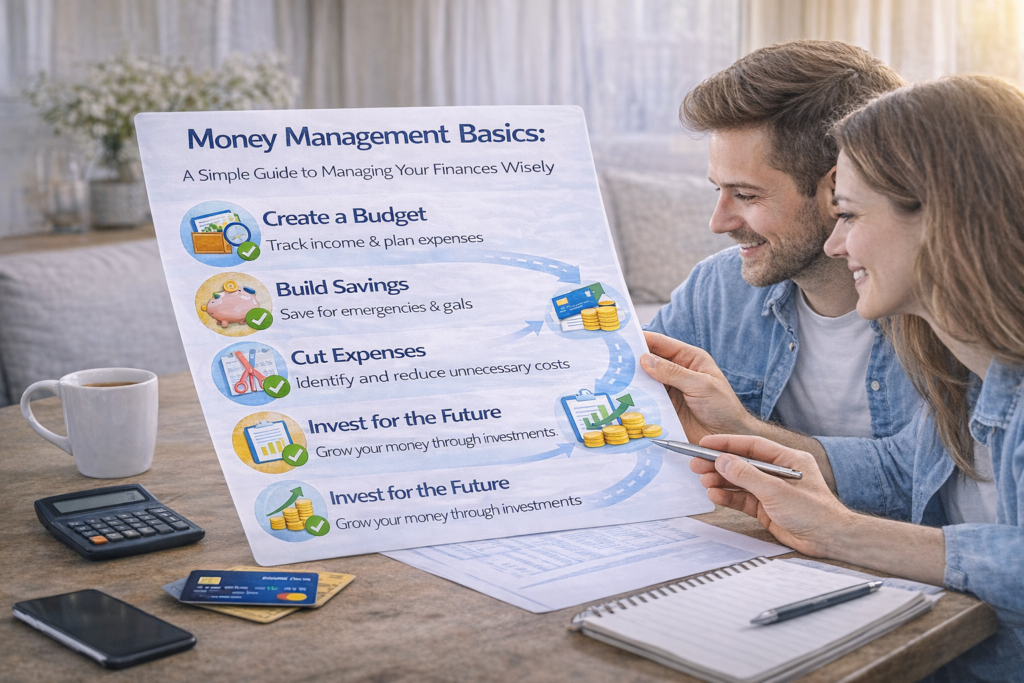

Understanding money management basics is an essential step toward building healthy financial habits. Everyday financial decisions—such as paying bills, planning expenses, or saving money—can feel overwhelming without a clear system. Learning the fundamentals of money management helps create structure and confidence when handling personal finances.

Money management does not require complex strategies or advanced financial knowledge. Instead, it focuses on awareness, organization, and consistency. This guide explains the basics of money management in a clear and practical way, making it easier to apply these concepts in daily life.

What Are Money Management Basics?

Money management basics refer to the foundational principles used to organize income, control spending, and develop responsible financial habits. These basics help individuals understand how money flows through their lives and how small decisions can affect overall financial stability.

At a fundamental level, money management is about making intentional choices. By understanding income, expenses, and priorities, individuals can create a balanced approach to handling money without unnecessary stress.

Understanding Your Income

Income awareness is the starting point of money management. Knowing where money comes from and how consistent it is helps establish realistic expectations.

Some individuals earn a fixed income, while others experience fluctuations. Tracking income over time allows for better planning and reduces uncertainty. Understanding income patterns also helps avoid overspending based on assumptions rather than actual availability.

Creating a Basic Money Management Plan

A basic money management plan provides structure for handling finances. This plan does not need to be detailed or rigid. Instead, it outlines how income is generally allocated toward expenses, savings, and other priorities.

Having a simple plan helps individuals:

- Stay organized

- Anticipate regular expenses

- Make informed spending decisions

The goal is clarity, not perfection.

Budgeting as a Money Management Tool

Budgeting is a core component of money management basics. A budget helps individuals see how money is used and whether spending aligns with income.

Beginner-friendly budgeting approaches focus on simplicity. Common methods categorize expenses into essentials, discretionary spending, and savings. This structure makes budgeting easier to maintain and review over time.

Tracking Expenses and Spending Habits

Tracking expenses is an effective way to improve money awareness. When expenses are reviewed regularly, spending habits become easier to understand.

Expense tracking helps individuals:

- Identify recurring expenses

- Recognize unnecessary spending

- Adjust habits when needed

Simple tracking methods are often more sustainable than complex systems.

Managing Spending Responsibly

Spending management involves balancing needs and wants. Needs typically include essential living expenses, while wants are discretionary purchases.

Understanding this distinction helps prioritize spending and reduces financial pressure. Responsible spending does not eliminate enjoyment but encourages thoughtful choices that align with financial priorities.

The Importance of Saving Money

Saving is a key part of money management basics. It provides flexibility and supports financial preparedness.

At the beginner level, saving focuses on consistency rather than amount. Small, regular contributions help establish the habit of saving and build confidence over time.

Understanding short-term and long-term saving goals helps individuals organize priorities and avoid using funds unintentionally.

Building Consistent Money Management Habits

Consistency is one of the most important factors in effective money management. Habits such as reviewing expenses, checking budgets, and planning ahead reinforce financial awareness.

Developing consistent habits takes time. Progress comes from repeating small actions regularly rather than making drastic changes all at once.

Common Money Management Challenges

Many people face similar challenges when learning money management basics. These challenges often include overspending, lack of planning, and inconsistent habits.

Without structure, finances can feel unpredictable. Recognizing these challenges allows individuals to approach money management with patience and realistic expectations.

Using Simple Tools for Money Management

Simple tools can support money management by improving organization. These may include basic budgeting templates, expense trackers, or educational resources.

The purpose of these tools is to support awareness, not to complicate the process. Easy-to-use tools are more likely to be maintained consistently.

Improving Financial Awareness Over Time

Financial awareness grows through regular review and reflection. As individuals become more familiar with their finances, decision-making becomes more confident and intentional.

Improved awareness supports adaptability and long-term financial stability.

Frequently Asked Questions

What are money management basics?

Money management basics are the foundational practices used to organize income, manage expenses, and build responsible financial habits.

Is money management difficult to learn?

Money management is not difficult when learned step by step. The basics are practical and accessible for most people.

Do I need a budget for money management?

A basic budget is helpful but does not need to be detailed. Even simple planning improves financial clarity.

How long does it take to improve money management habits?

Habit-building varies by individual, but consistent effort over time leads to noticeable improvement.

Final Thoughts

Learning money management basics is a gradual process that improves with consistency and patience. Rather than focusing on immediate results, building awareness and simple routines supports long-term progress.

Money management basics provide a practical foundation for handling everyday financial decisions with greater confidence and clarity.