Introduction: Personal Finance Basics Explained Simply

What Are Personal Finance Basics?

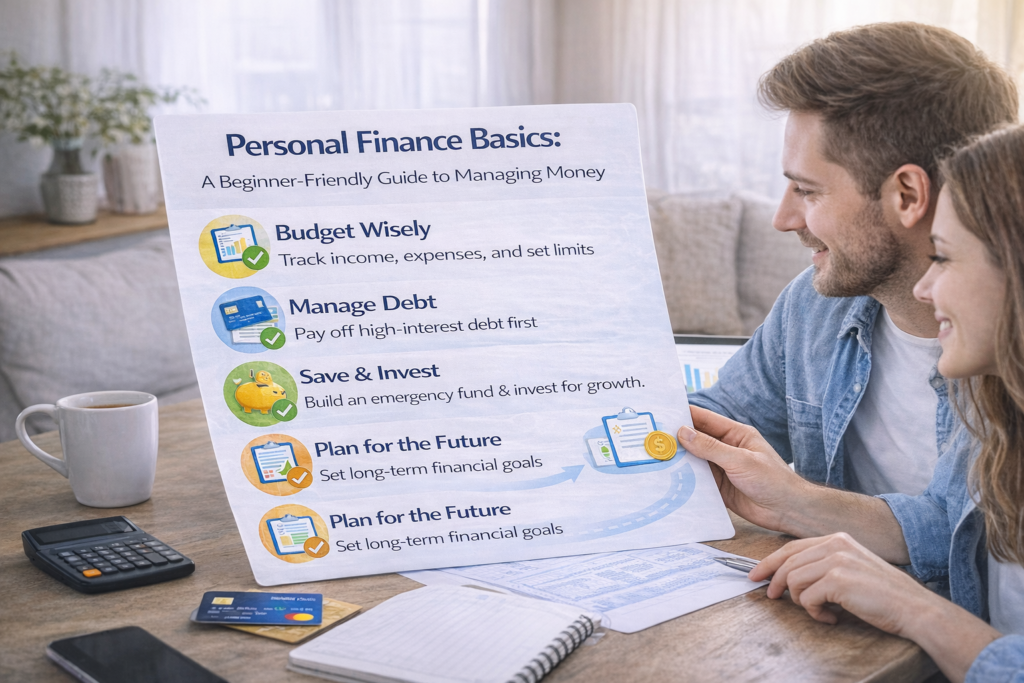

Personal finance basics refer to the fundamental concepts and everyday practices that individuals use to manage their money in a practical and responsible way. At this level, personal finance is not about complex financial products or advanced strategies. Instead, it focuses on understanding how money flows in and out of daily life and how simple decisions can influence financial stability over time.

Definition of Personal Finance

Personal finance is the process of planning, organizing, and monitoring individual financial resources. It includes how people earn income, manage expenses, and make informed decisions about their money. The purpose of personal finance at a basic level is to create awareness and structure, helping individuals understand their financial situation clearly. Rather than aiming for perfection, personal finance basics encourage consistency, intentional choices, and realistic planning that fits everyday life.

Scope of Personal Finance Basics

The scope of personal finance basics covers several core areas that affect nearly everyone. These include income awareness, budgeting, saving, and spending management. Income awareness involves knowing where money comes from and recognizing its reliability. Budgeting basics focus on creating a simple plan to align income with regular expenses. Saving at the beginner level emphasizes the importance of setting aside money, even in small amounts, to prepare for expected and unexpected needs. Spending management highlights the value of distinguishing between needs and wants and tracking where money goes.

Together, these areas form a foundation that supports better financial organization. Personal finance basics do not require advanced knowledge or special tools. They are designed to be flexible and accessible, allowing individuals to adapt them to different income levels and lifestyles.

Everyday Relevance of Money Management

Money management plays a role in nearly every daily decision, from paying bills to making purchasing choices. Understanding personal finance basics helps individuals approach these decisions with greater confidence and clarity. When people are aware of their financial habits, they are better prepared to avoid unnecessary stress and confusion related to money.

Everyday money management also supports long-term financial well-being. Simple actions such as reviewing expenses, planning ahead, and maintaining consistent habits can create a sense of control over personal finances. Over time, these basic practices contribute to improved financial awareness and more thoughtful decision-making, making personal finance basics an essential life skill for individuals at any stage.

Why Personal Finance Basics Matter

Understanding personal finance basics plays an important role in how individuals interact with money on a daily basis. These foundational concepts help create awareness, guide everyday decisions, and support long-term financial stability. Rather than focusing on outcomes or specific financial goals, personal finance basics emphasize knowledge, habits, and consistency—elements that remain valuable across different life stages and income levels.

Importance of Financial Awareness

Financial awareness is one of the most important outcomes of learning personal finance basics. It involves knowing how much money comes in, how it is used, and where potential gaps may exist. This awareness allows individuals to clearly see their financial situation instead of making assumptions or reacting to problems as they arise.

When people develop financial awareness, they are more likely to notice spending patterns, recurring expenses, and areas where money may be misaligned with priorities. This clarity supports more intentional behavior and reduces uncertainty. Even simple awareness—such as regularly reviewing expenses or understanding monthly obligations—can make money management feel more organized and less overwhelming.

Impact on Daily Decision-Making

Personal finance basics directly influence everyday decision-making. From choosing how to allocate income to deciding whether a purchase fits within a budget, these decisions are easier when basic financial principles are understood. Without this foundation, money-related choices are often made impulsively or without full consideration of their impact.

With basic financial knowledge, individuals are better equipped to evaluate trade-offs and plan ahead. For example, understanding budgeting basics helps people consider how current spending may affect upcoming expenses. This leads to more thoughtful choices that align with personal priorities and responsibilities, rather than short-term convenience.

Long-Term Benefits of Financial Knowledge

The long-term benefits of understanding personal finance basics extend beyond daily routines. Over time, consistent application of basic financial principles can improve confidence, organization, and overall financial well-being. Individuals who understand the fundamentals are more likely to adapt successfully to changes such as shifts in income or new financial responsibilities.

Financial knowledge also supports lifelong learning. Once the basics are established, individuals can build on that foundation as their needs evolve. Even without advanced financial expertise, a strong understanding of personal finance basics helps create stability and encourages responsible habits that remain useful throughout life.

Core Areas of Personal Finance

Personal finance basics are built around several core areas that work together to support responsible money management. These areas help individuals understand how money is earned, planned, saved, and spent in everyday life. Focusing on these fundamentals creates a practical framework that can be adjusted to different lifestyles and financial situations.

Income Awareness

Understanding income sources

Income awareness begins with clearly identifying where money comes from. This may include wages, salaries, freelance work, or other regular sources. At a basic level, understanding income means knowing how often money is received, whether it is consistent, and how dependable it is. This clarity helps individuals plan realistically and avoid relying on income that may fluctuate unexpectedly.

Tracking income consistency

Tracking income consistency involves paying attention to patterns over time. Some individuals receive the same amount regularly, while others experience changes from month to month. Recognizing these patterns helps with planning expenses and setting realistic expectations. Even simple tracking methods can improve awareness and reduce uncertainty when managing money.

Budgeting Fundamentals

Purpose of budgeting

The purpose of budgeting is to create a basic plan for how income is used. Budgeting does not need to be complex to be effective. At the beginner level, it serves as a tool to organize expenses, prioritize responsibilities, and ensure that spending aligns with available income. A basic budget supports balance and helps prevent unplanned overspending.

Common beginner-friendly budgeting methods

Beginner-friendly budgeting methods focus on simplicity. These methods typically divide income into general categories such as essential expenses, discretionary spending, and savings. The goal is not precision, but consistency. Using a straightforward approach makes budgeting easier to maintain over time and encourages regular review.

Saving Concepts

Why saving matters

Saving is an essential part of personal finance basics because it provides flexibility and preparation. Even small, consistent savings can help individuals feel more secure and better prepared for routine expenses or unexpected situations. At the basic level, saving emphasizes habit-building rather than specific targets.

Short-term vs. long-term saving goals

Short-term saving goals often focus on near-future needs, while long-term saving goals are associated with broader plans. Understanding the difference helps individuals organize priorities and avoid using funds intended for other purposes. Both types of goals benefit from regular contributions and clear intent.

Spending Management

Needs vs. wants

Spending management begins with distinguishing between needs and wants. Needs generally relate to essential living expenses, while wants are discretionary. Recognizing this difference supports more thoughtful spending decisions and helps individuals align purchases with priorities.

Monitoring spending habits

Monitoring spending habits involves paying attention to where money goes over time. Regular review of expenses can reveal patterns and encourage adjustments when needed. This awareness supports better control and reinforces responsible money management as part of everyday life.

Common Personal Finance Challenges for Beginners

Many people who are new to personal finance face similar challenges when learning how to manage money effectively. These challenges are not usually caused by a lack of effort, but rather by limited experience and unclear systems. Understanding common obstacles helps beginners recognize potential issues early and approach money management with greater awareness and patience.

Lack of Budgeting

One of the most common challenges for beginners is the absence of a basic budgeting system. Without a simple plan, it becomes difficult to understand how income is being used or whether expenses align with available resources. A lack of budgeting often leads to uncertainty, making it harder to anticipate upcoming expenses or adjust spending when needed.

Beginners may avoid budgeting because it feels restrictive or complicated. However, at the basic level, budgeting is meant to provide clarity rather than control. Even a minimal structure can improve organization and support better decision-making. Without this foundation, financial habits tend to develop reactively rather than intentionally.

Overspending Issues

Overspending is another frequent challenge, especially when spending decisions are made without clear awareness of limits. This issue often arises when individuals do not track expenses or underestimate how small purchases add up over time. Overspending does not always involve large purchases; it is often the result of repeated, unplanned spending.

For beginners, overspending may also be influenced by difficulty distinguishing between essential expenses and discretionary purchases. Without a clear understanding of priorities, spending choices can feel disconnected from overall financial goals. Developing basic awareness and reviewing spending regularly can help reduce this challenge over time.

Inconsistent Financial Habits

Inconsistent financial habits can make personal finance feel unpredictable and stressful. Beginners may start strong with tracking or budgeting but struggle to maintain these habits consistently. This inconsistency often comes from setting unrealistic expectations or trying to change too many behaviors at once.

Personal finance basics emphasize gradual improvement rather than perfection. When habits are inconsistent, progress may feel slow, but this is a normal part of learning. Building consistency through simple, repeatable actions helps establish a routine and reinforces positive behaviors over time.

Recognizing these common challenges allows beginners to approach personal finance with greater understanding and flexibility. Awareness of these obstacles is the first step toward developing more stable and sustainable money management practices.

How to Get Started With Personal Finance Basics

Getting started with personal finance basics does not require advanced knowledge or complex systems. The goal at this stage is to build awareness, establish simple routines, and create habits that support better money management over time. By focusing on realistic actions and consistency, beginners can develop a strong foundation without feeling overwhelmed.

Setting Realistic Financial Goals

Setting realistic financial goals is an important first step in personal finance. At the beginner level, goals should be clear, achievable, and aligned with current circumstances. Rather than focusing on large or long-term outcomes, it is often more effective to start with short-term objectives that support everyday stability.

Realistic goals help provide direction and motivation. They allow individuals to measure progress without unnecessary pressure. The emphasis is not on speed, but on creating manageable steps that encourage ongoing engagement with personal finances. Clear goals also support better decision-making by offering a reference point when evaluating spending and planning.

Using Simple Tools and Resources

Personal finance basics are best supported by simple tools and accessible resources. These may include basic expense trackers, budgeting templates, or educational materials that explain concepts in straightforward terms. The purpose of these tools is to support awareness and organization, not to create complexity.

Using simple tools makes it easier to maintain consistency. When systems are easy to use, individuals are more likely to review their finances regularly and stay engaged. Educational resources also play a role by reinforcing understanding and encouraging continuous learning at a comfortable pace.

Building Consistent Money Habits

Consistency is one of the most important factors in successful money management. Building consistent habits involves repeating small actions regularly, such as reviewing expenses or checking progress toward goals. These habits help reinforce awareness and reduce uncertainty around finances.

For beginners, consistency matters more than perfection. Missed steps or adjustments are part of the learning process. Over time, consistent habits create structure and confidence, making personal finance feel more manageable and less stressful. By focusing on routine and simplicity, individuals can gradually improve their financial skills and understanding.

Frequently Asked Questions (FAQ)

What Does Personal Finance Mean?

Personal finance refers to how individuals manage their money in everyday life. It includes understanding income, organizing expenses, planning how money is used, and developing habits that support financial stability. At a basic level, personal finance focuses on awareness and decision-making rather than complex systems. The goal is to help individuals feel more in control of their finances by understanding where money comes from and how it is used.

Is Personal Finance Difficult to Learn?

Personal finance is not difficult to learn, especially when approached step by step. The basics are designed to be accessible and practical, focusing on simple concepts such as budgeting, saving, and spending awareness. While financial topics can seem overwhelming at first, starting with foundational principles makes learning more manageable. With consistent practice and realistic expectations, most people can develop a solid understanding over time.

Do Beginners Really Need a Budget?

For beginners, having a basic budget is helpful but does not need to be detailed or restrictive. A budget provides structure by outlining how income is generally allocated across expenses and priorities. This structure helps reduce uncertainty and supports better decision-making. Even a simple budgeting approach can improve financial organization and make money management feel more intentional.

How Long Does It Take to Improve Money Habits?

Improving money habits is a gradual process that varies from person to person. Progress depends on consistency rather than speed. Small, repeated actions—such as tracking expenses or reviewing finances regularly—help build habits over time. While noticeable improvements may take weeks or months, the focus should remain on steady progress and long-term learning rather than quick results.

Final Thoughts

Learning personal finance basics is an ongoing process rather than a one-time task. Financial situations, priorities, and responsibilities can change over time, making continuous learning an important part of effective money management. By staying open to learning and regularly reviewing financial habits, individuals can adapt more easily and maintain a clearer understanding of their finances.

Continuous learning does not require advanced knowledge or constant research. It can be as simple as reflecting on financial decisions, revisiting basic concepts, or gradually expanding understanding as confidence grows. This approach supports long-term awareness and helps reinforce the foundational principles of personal finance.

Consistency and patience are equally important when developing financial skills. Progress is often gradual, and meaningful improvement comes from repeating small, manageable actions over time. Consistent habits—such as monitoring expenses, reviewing budgets, or setting realistic goals—create stability and reduce uncertainty.

Patience allows individuals to focus on sustainable progress rather than immediate results. Mistakes and adjustments are a normal part of learning personal finance. By maintaining a steady approach and realistic expectations, individuals can build confidence and strengthen their financial understanding.

In the long run, personal finance basics provide a practical framework for navigating everyday financial decisions. With consistency, patience, and a commitment to learning, individuals can develop habits that support long-term financial awareness and responsible money management.