Introduction

Learning personal finance basics can make everyday money decisions feel more manageable. Whether you’re paying bills, planning monthly expenses, or trying to build better habits, understanding a few core concepts can bring clarity and reduce stress. The goal isn’t perfection—it’s building a foundation you can rely on.

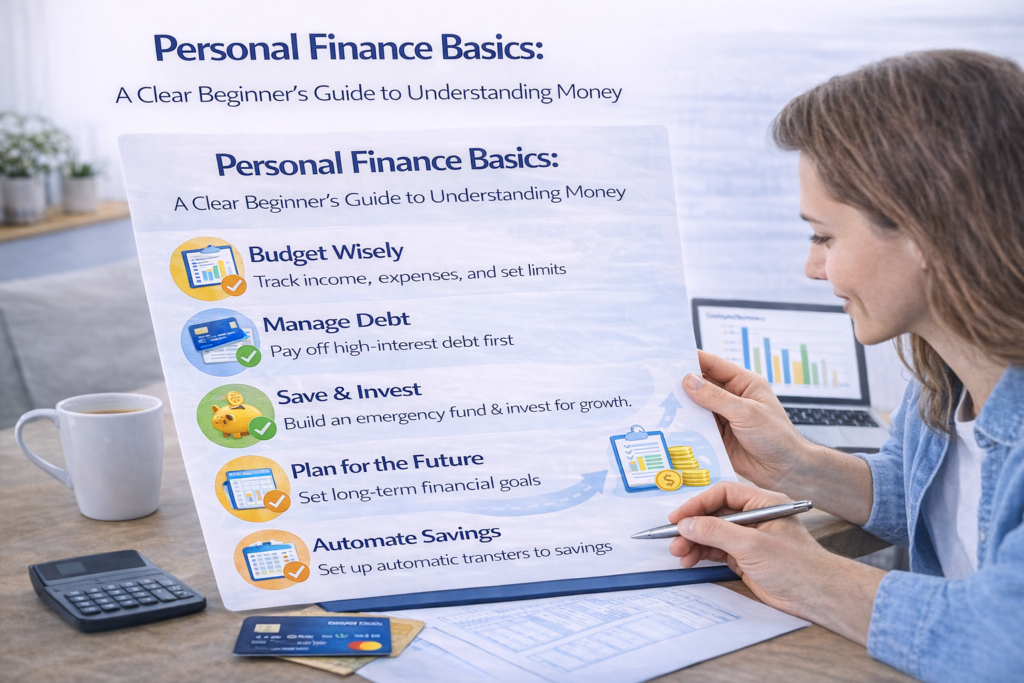

This guide explains personal finance in simple terms, focusing on the basics most people use in daily life: income awareness, budgeting, saving, spending management, and long-term planning concepts.

What Are Personal Finance Basics?

Personal finance basics are the core ideas and habits that help individuals manage money responsibly. At a beginner level, personal finance usually includes:

- Understanding income and cash flow

- Creating a basic spending plan (budget)

- Tracking expenses

- Building a saving habit

- Managing spending intentionally

- Reviewing and adjusting regularly

Personal finance is less about complex tools and more about consistent habits and clear awareness.

Why Personal Finance Basics Matter

Even small money decisions can add up over time. Knowing the basics helps you:

- Plan for regular expenses

- Avoid common overspending patterns

- Build confidence in everyday decisions

- Stay organized through life changes

When you understand the fundamentals, you’re less likely to rely on guesswork and more likely to make intentional choices.

Core Areas of Personal Finance

Income Awareness

Knowing how much money comes in—and how consistent it is—helps you plan realistically. If income varies, tracking patterns over time can help you set practical expectations.

Budgeting Fundamentals

A budget is simply a plan for how you intend to use your money. It helps align income with expenses and supports better decision-making.

Saving Concepts

Saving builds flexibility. Even small, consistent savings can support preparedness for irregular or unexpected costs.

Spending Management

Spending management includes understanding priorities and distinguishing needs from wants. It’s about balance, not restriction.

Common Beginner Challenges

Beginners often face:

- No clear budget or plan

- Tracking spending inconsistently

- Forgetting irregular expenses (annual fees, seasonal costs)

- Trying to change everything at once

A simple system and weekly review can help.

How to Start With Personal Finance Basics

Start small and focus on consistency:

- Identify your monthly income range

- List essential expenses

- Choose a simple budget method

- Track spending weekly

- Set a small, realistic savings habit

- Review and adjust monthly

FAQ

What is personal finance?

It’s how individuals manage income, expenses, saving, and spending in everyday life.

Is personal finance hard to learn?

Not when approached step by step. The basics are practical and accessible.

Where should beginners start?

Income awareness + a simple budget + basic expense tracking.

How long does it take to build good money habits?

It varies, but consistent weekly check-ins often create noticeable improvement over time.

Final Thoughts

Personal finance basics are about clarity and consistency. When you understand the core areas and build simple habits, managing money becomes more organized and less stressful over time.