Introduction

If you’ve ever applied for an apartment, a phone plan, a loan, or a credit card, you may have heard the phrase “credit score.” But for beginners, it can be unclear what a credit score actually represents and why it matters.

This guide answers the question: What is a credit score and how does it work? You’ll learn:

- what a credit score is in simple terms

- how credit reports connect to credit scores

- common factors used in scoring models (in general)

- how credit utilization and payment timing fit into the picture

- practical, educational habits that support credit awareness

Credit scoring details vary by model and situation, so this article focuses on widely discussed concepts rather than personal recommendations.

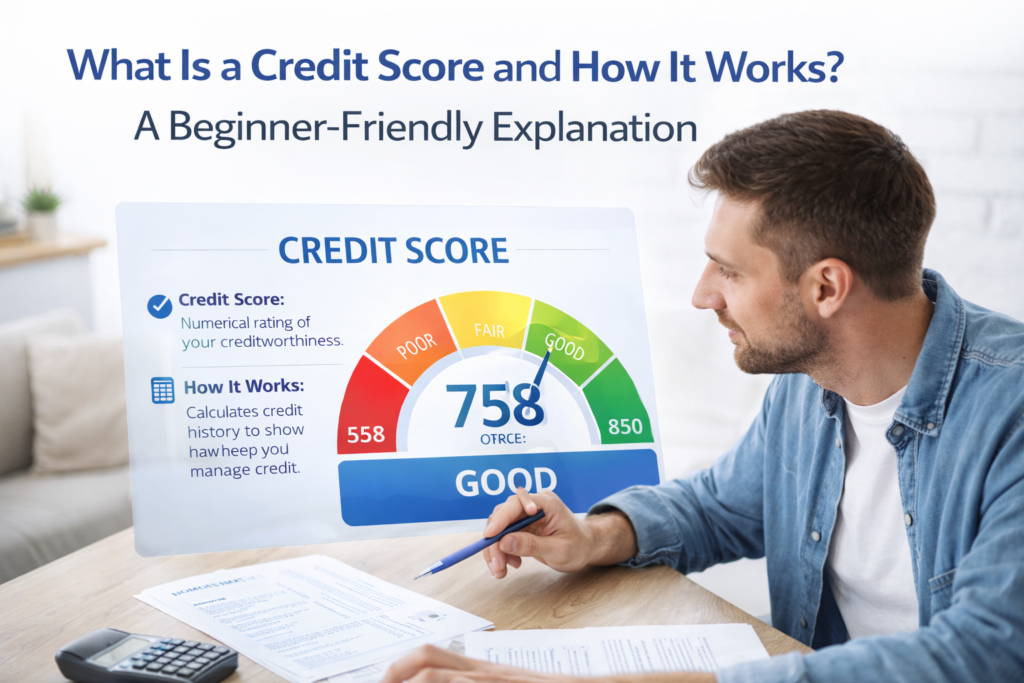

What Is a Credit Score?

A credit score is a number used to summarize information from your credit history. It’s designed to help lenders and other organizations assess credit-related risk using a standardized score.

In general terms, credit scores are calculated using data found in your credit report—a record that may include:

- credit accounts (like credit cards or loans)

- payment history on those accounts

- balances and credit limits (where applicable)

- how long accounts have been open

- recent inquiries or applications (where applicable)

Different scoring models exist, and they may weigh factors differently. That’s why scores can vary depending on the source and model used.

What Is a Credit Report (And Why It Matters)?

A credit report is the underlying record that can feed into a credit score. Think of it like the “data file,” while the score is the “summary number.”

A credit report may include:

- identifying information (name, address, etc.)

- account information (types of accounts and status)

- payment history (on-time vs. late, based on reporting)

- credit inquiries (applications or checks that may be recorded)

- public record information where applicable (varies and is limited in many contexts)

Because the credit score is derived from report data, understanding the report conceptually helps you understand the score.

How a Credit Score Works (High-Level)

At a high level:

- Credit activity is reported to credit bureaus (depending on the creditor and account type).

- The credit report stores that history.

- A scoring model analyzes the report data.

- A credit score is produced based on the model’s formula.

Different models can produce different results from the same report data.

Common Factors That Influence Credit Scores (General Concepts)

While exact scoring formulas vary, credit education commonly references a few core categories:

1) Payment history (general importance)

Payment history generally reflects whether payments were made on time, based on what’s reported. Late payments can be seen as negative signals in many scoring systems.

Beginner concept: Consistent on-time payments are widely viewed as a key part of credit history.

2) Credit utilization (credit card balances vs. limits)

Credit utilization generally refers to how much revolving credit you’re using relative to limits.

Example:

- Limit: $2,000

- Balance: $600

- Utilization: 30%

Utilization is often discussed as a factor in many scoring frameworks, especially for revolving accounts.

Beginner concept: High utilization can signal heavier reliance on credit at a moment in time.

3) Length of credit history

This refers to how long credit accounts have been open and the overall age of your credit profile. Longer histories can provide more data.

4) Credit mix (types of accounts)

Some scoring models may consider whether a credit profile includes different types of credit (for example, revolving vs. installment). The importance of this varies by model.

5) New credit and inquiries

Opening multiple accounts in a short period or having multiple inquiries may affect scores depending on the model and context.

Important: The weight of each factor depends on the scoring model used.

Why Credit Scores Matter in Everyday Life

Credit scores may be used in decisions related to:

- credit card applications

- loans (auto, personal, mortgage—depending on context)

- rental applications (in some cases)

- insurance pricing in some states (rules vary)

- utility or phone plan approvals (varies by company)

Because credit scores can influence approvals and terms, understanding how they work can help people approach credit more confidently.

Credit Cards and Credit Scores: How They Connect

Credit cards are one of the most common ways people build credit history. Concepts that often matter in credit score discussions include:

Statement balance and reporting timing

Some credit card balances may be reported around statement time, depending on the issuer’s reporting practices.

Utilization and revolving balances

Credit utilization is typically discussed in relation to revolving credit like credit cards.

Payment timing

Making payments on time is commonly emphasized because payment history is widely referenced as a key factor.

Because reporting practices can vary, it helps to understand your statement cycle and keep a consistent routine for reviewing and paying.

Common Myths About Credit Scores

Myth 1: Checking your own score always hurts it

Not necessarily. Many systems distinguish between consumer checks and application-related inquiries. The effect depends on the type of inquiry and context.

Myth 2: You need to carry a balance to build credit

This is a common misconception. Credit building concepts are typically tied to reported history and on-time payments. Whether carrying a balance helps depends on many factors and is not required in many general explanations.

Myth 3: One number tells the whole story

Scores are summaries. Lenders may also review the credit report itself and other information.

Beginner-Friendly Credit Awareness Habits

These are educational habits that support clarity and organization:

Habit 1: Understand billing cycles and due dates

Knowing your due dates helps avoid missed payment timing.

Habit 2: Review statements regularly

Statements help you see activity and confirm accuracy.

Habit 3: Track spending to avoid surprise balances

Expense tracking supports budgeting and helps keep credit use predictable.

Habit 4: Keep a simple money routine

Weekly check-ins help you stay consistent without obsessing.

Habit 5: Learn the basics of utilization

Utilization is a useful awareness concept even if you’re not focusing on scoring.

These habits connect credit education to personal finance basics.

How Credit Scores Differ by Model

It’s normal to see different credit scores from different sources. Reasons include:

- different scoring models

- different data update timing

- different bureau data (not all accounts report identically everywhere)

The key beginner takeaway: focus on the fundamentals of credit history and responsible routines rather than obsessing over daily score changes.

FAQ

What is a credit score?

A credit score is a number that summarizes information from your credit history, generally based on data in your credit report.

How does a credit score work?

Credit activity can be reported to credit bureaus; scoring models analyze the credit report data and produce a score using their formula.

What affects credit scores the most?

Many general explanations emphasize factors like payment history and credit utilization, but exact weights vary by scoring model.

Why are my credit scores different in different places?

Different sources may use different scoring models or have different data update timing.

Do credit cards affect credit scores?

Credit cards are commonly linked to credit history through reported account data, balances, and payment records (depending on issuer reporting).

Final Thoughts

A credit score is a simplified number designed to summarize aspects of your credit history. It generally comes from credit report data and is influenced by common categories like payment history, utilization, and the age of accounts—though exact formulas vary by scoring model.

For beginners, the best approach is understanding the system: learn statement timing, stay organized with due dates, track spending patterns, and build consistent routines. Over time, financial clarity and steady habits make credit-related topics far easier to manage.